What does TTM stand for?

Since financial markets are subject to fluctuations and seasonality, the trailing twelve months provide a more accurate and up-to-date picture of a company’s performance during the most recent year. It enables investors to make informed decisions based on the latest available data, as opposed to relying solely on data from the end of the previous fiscal year. TTM also stands for “Trailing Twelve Months” or “Trailing 12 Months” in the financial industry. This term refers to the past twelve months or one year of performance data from a company.

However, it is now used far beyond this subculture and is not limited to certain age groups, or to social media. For instance, an influencer shares a story on Instagram with the caption, “It’s a beautiful day to be alive, TTM” expressing his/her willingness to have a free dialogue with his/her followers. The acronym “TTM,” which stands for “Talk to Me,” has become the most widely used and popular slang term among the Gen Z (the digital native generation).

Moderna (MRNA) Stock Price Might Drop to $100 After Earnings – The Coin Republic

Moderna (MRNA) Stock Price Might Drop to $100 After Earnings.

Posted: Wed, 02 Aug 2023 07:51:51 GMT [source]

Trailing 12 months (TTM) figures report metrics based on the last 12 months (or four quarters) to date on a rolling basis. In addition to being used to measure recent trends or annual performance, TTM financial metrics are frequently used to compare the relative performance of similar companies within an industry or sector. Financial metrics commonly considered by looking at the last twelve months of figures include a company’s sales, stock returns, dividend yield, price-earnings (P/E) ratio and earnings per share (EPS). TTM is a financial term that stands for «trailing 12 months.» It refers to the past 12 consecutive months of a company’s financial performance. You calculate TTM figures with data from a company’s quarterly reports, either taken directly from those reports or as reported by your favorite font of financial information. The current TTM data at any time is the sum of the four latest reports of revenue, earnings, and other metrics.

In social media, the gaming and beauty communities on Instagram seem to promote this acronym more than others. On the whole,the term is a wonderful acronym that takes the fear out of the audience and encourages them to communicate and sometimes empathize with the influencer. Slang like this is typical of the influencer community and is often used in their captions and stories to create space for conversations with their followers.

Premium Investing Services

TTM data is often used in things like balance sheets, income statements and cash flow charts. By keeping a running tab of TTM metrics, a firm’s management and stakeholders can understand how the company is doing at any point in time using an apples-to-apples comparison. In other words, by always looking at the previous 12 months, effects such as seasonality or one-time charges can be smoothed out. Used to analyze mutual fund or exchange-traded fund (ETF) performance, TTM yield refers to the percentage of income a portfolio has returned to investors over the last 12 months.

This formula starts with a company’s annual financial report, then adds the reports for any quarters following the annual report, then subtracts the corresponding quarterly from the annual report. As you can see, Target’s revenue rose steadily in this period, while Altria’s top-line sales declined. This view smooths out any short-term fluctuations in revenue that might be caused by seasonal factors or one-time items.

Trailing 12 Months (TTM): Definition, Calculation, and How It’s Used

Using trailing 12-month (TTM) figures is an effective way to analyze the most recent financial data in an annualized format. TTM Revenue describes the revenue that a company earns over the trailing 12 months (TTM) of business. This data is instrumental in determining whether or not a company has experienced meaningful top-line growth, and can pinpoint precisely where that growth is coming from. However, this figure is often overshadowed by a company’s profitability, and its capability for generating earnings before interest, tax, depreciation, and amortization (EBITDA). Line items on the cash flow statement (e.g., working capital, capital expenditures, and dividend payments) should be treated based on the feeding financial statement.

- In social media, the gaming and beauty communities on Instagram seem to promote this acronym more than others.

- Musician Lil Nas X, for example, often uses TTM in his captions, asking his followers to share their thoughts and feelings about his new music.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- TTM data is often used in things like balance sheets, income statements and cash flow charts.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

With TTM figures, we can get a more accurate picture of a company’s ability to perform over a longer period, across various market conditions and economic environments. Trailing twelve months calculations will depend on which financial metric is being considered. In general, TTM calculations will either (1) add up the figures from the previous 12 months (or four quarters) as a sum; or (2) take the average or weighted average of the previous 12 months’ figures. Trailing P/E is a relative valuation multiple that is based on the last 12 months of actual earnings, and is calculated by taking the current stock price and dividing it by the TTM earnings per share (EPS). Much of fundamental analysis involves comparing a measurement against a like measurement from a prior term, to decipher how much growth was realized. This marked improvement provides a clear snapshot of the company’s growth trajectory.

Get Your Questions Answered and Book a Free Call if Necessary

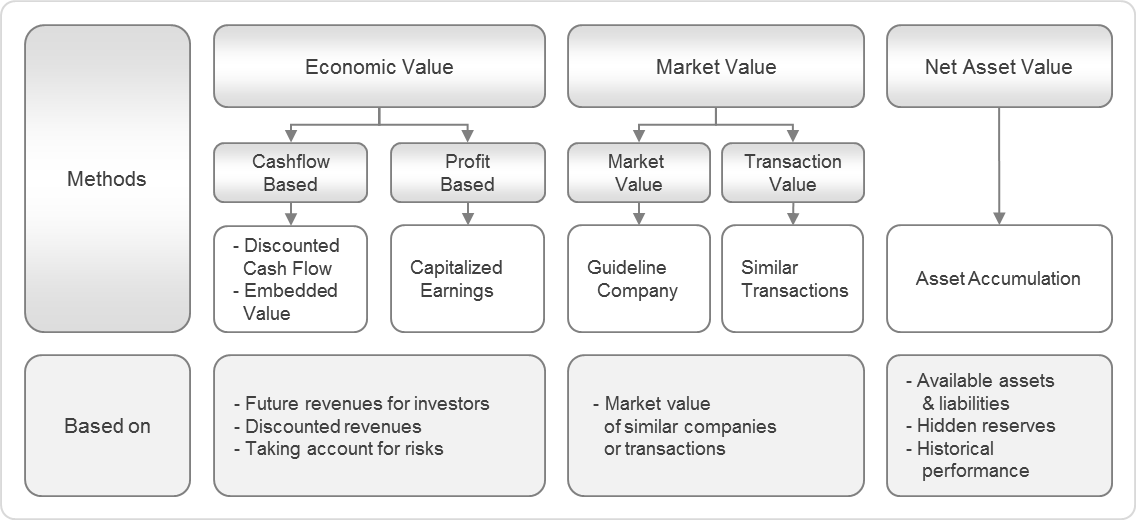

This metric tells you what a company would be worth if sold and is another way to value it.

Securities and Exchange Commission (SEC) filings generally display financial results on a quarterly or year-to-date basis rather than TTM. By using TTM, analysts can evaluate the most recent monthly or quarterly data rather than looking at older information that contains full fiscal or calendar year information. TTM charts are less useful for identifying short-term changes and more useful for forecasting. Earnings per Share, or EPS, is valued by analysts as a key indicator of the overall profitability of a company. Thus, some analysts often overlook this metric in order to focus more on profitability. However, it can still be vital in determining the strengths and weaknesses of a company’s revenue-generating practices.

Everything You Need To Master Financial Modeling

And, TTM can be an extremely effective slang term for building a strong and loyal personal brand, reaching new audiences, and driving engagement. This feature can also be used effectively to discreetly answer questions from their followers. This encourages the followers and creates an opportunity to interact and share their favorite delicacies in a lively conversation.

CleanSpark (CLSK) to Report Q3 Earnings: What’s in the Offing? – Nasdaq

CleanSpark (CLSK) to Report Q3 Earnings: What’s in the Offing?.

Posted: Mon, 07 Aug 2023 16:22:00 GMT [source]

For example, working capital is compiled from balance sheet line items, which are averaged. However, depreciation is deducted from income on a quarterly basis; so analysts look at the last four quarters as reported on the income statement. Trailing 12 months (TTM) is a common term referring to a way to measure the performance of a company over time.

TTM Revenue

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. There is another, slightly more complicated TTM formula, but it is used more frequently because it is better adapted to the tools and datasets most commonly at an analyst’s disposal. Start with the most recent quarter–for instance, to make a TTM calculation in July 2020, one would begin with Q2, which ended in June 2020. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

The easiest way to calculate data from the trailing 12 months is to add by the previous four quarters, the three-month periods into which the fiscal year is broken up. TTM Revenue, for example, indicates the amount of revenue that a company has earned over the trailing twelve months. This is a key indicator which can determine whether a company is experiencing growth, and if so, where that growth is coming from.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. You are most likely to see it in DMs, but this term can also pop up in Stories, posts, and videos when a user is speaking to a broader group of people. For example, it might be employed when you are eager to hear about a specific topic or when you simply want to have a light conversation. Understanding the situation and the tone of the message is important when using TTM – talk to me to ensure a smooth and appropriate interaction.

You can also shift to a set of four consecutive reporting periods to analyze how the TTM value has changed over time. This term is commonly used to analyze and evaluate a company’s performance data, including revenue, earnings, and metrics. Trailing 12 Months is a measurement of a company’s financial figures over the past 12-month period, rather than traditional fiscal years. TTM – trailing 12 months is used to report financial figures that do not necessarily coincide with a calendar year or a fiscal-year ending period.

For example, if two quarters have passed since the latest fiscal year, the quarterly data that we would deduct is the first two quarters from the prior year. To calculate a company’s revenue on a TTM basis, the following three steps can be followed. Learn about the meaning and usage of other slang expressions like DTB and DTN on Netinfluencer.com to use them more effectively on your social media. Christina frequently engages with her audience via Instagram posts and the hashtag TTM, asking and addressing how she has “uncomfortable conversations with kids” and soliciting answers from her followers. Many Micro-influencers like Christina Ygre, a fashion, beauty, and lifestyle influencer (who is also a mother), also use this acronym to engage in meaningful conversations with their followers. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Ask a Financial Professional Any Question

The Trailing Twelve Months (TTM) portrays a company’s financial performance across the past four quarters, i.e. the most recent 12-month period. Typically TTM figures are generated to show either the most recent twelve months of a company’s trading or to show the last twelve months of its trading before a certain event, such as an acquisition, took place. TTM stands for “trailing twelve months” and is a backward-looking metric that captures the financial performance of a company in its latest four reporting quarters.

- In another context, TTM stands for “trailing 12 months” a widely used term in the financial world, referring to the data from the past 12 consecutive months for reporting a company’s financial performance.

- Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

- Trailing P/E is a relative valuation multiple that is based on the last 12 months of actual earnings, and is calculated by taking the current stock price and dividing it by the TTM earnings per share (EPS).

- However, it is now used far beyond this subculture and is not limited to certain age groups, or to social media.

- In the equity research space, some analysts report earnings quarterly, while others do so annually.

These evaluations can include calculating key performance indicators such as net profit margin or liquidity. Although it is frequently used on Snapchat, the term wasn’t created on the platform, and you may see it used across a whole range of different social media apps including Instagram, WhatsApp, Facebook, TikTok, and more. For years now, Snapchat has been one of the most popular social media apps out there, allowing users to easily communicate with their friends and share posts with people on their contact list in the form of Stories. In texting and digital communication platforms, ttm stands for “Talk To Me.” This acronym is used as a simple request to initiate a conversation, indicating that the sender is willing to talk or discuss any topic.